A. Someday they will become a seller.

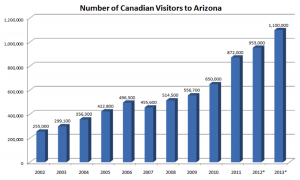

Above is a graph showing Canadians visiting Arizona by year

By the way, most AZ folks I know love Canadians. They take great amounts of pride in their homes and communities.

Talking about Canadian buyers is very easy. One common trait with all the Canadians I have dealt with (I specialize with my www.CanadiansInArizona.Net ) website is that they are impressed with the prices of homes in AZ. Whether they are looking for horse properties in Queen Creek or Palatial estates in Scottsdale. There is pretty much a home in every price range! So, buying is easy! Find a home, buy a home! One thing to mention when buying a home in Arizona is there is no SALES tax. a $200,000 home costs $200,000 plus buyer closing costs.

Owning an AZ property, you are required to pay property tax on the home and land. That amount can vary by city, but figure 1% of sales price. Each home for sale listed on the MLS will have past property tax amount and a buyer may check online for next years!

OK, I am done talking about buyers now. Really...

When a Canadian goes to sell their home, they should contact an Attorney and/or a CPA about tax implications.

Selling the home? According to the United States IRS, there is a big difference in selling a home for $299,000 verses $301,000

If the home sells for any amount OVER $300,000 the US Government will instruct the escrow (title insurance) company to withhold 10% of the sales price and send it directly to the IRS. The Canadian will need to file US taxes that year to receive some or all of the money that was withheld back.

If the home sells for UNDER $300,000 it may be exempt from the 10% withholding. If the home is being purchased by someone that plans to live in it full time or the buyer will occupy the home for 50% of the time it is occupied for 2 years.

I apologize if it is confusing, it makes sense in my head 🙂

Bottom line:

If a Canadian sells a home for OVER $300,000 the IRS will require 10% of the sales price. At tax time the seller will need to file US taxes to get some/all of the 10% back.

If a Canadian sells a home for UNDER $300,000 the transaction may be exempt. Talk to your agent about the tax withholding when an offer comes in.

Still confused? Google FIRPTA

Cheers, Brian